According to the Global Infrastructure Hub Annual General Infrastructure Investor Survey and the EDHEC Infrastructure Institute-Singapore, 37% of infrastructure investors invested in emerging markets in 2017, up from 20% in 2016. (Credits: GIH)

Two new reports released by the Global Infrastructure Hub, a G20 initiative, reveal a $ 1 trillion investment gap in 10 Compact with Africa countries over the next 22 years. Studies interested in the extent of investment opportunities in these countries and sectors of activity.

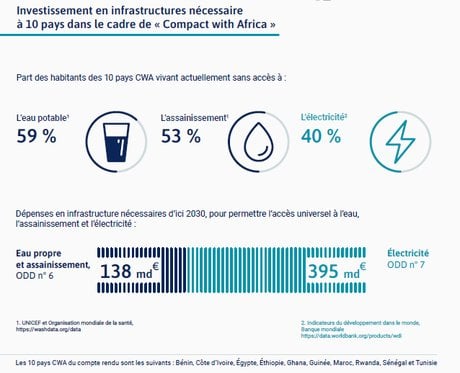

A group of 10 countries in the Compact with Africa program need $ 2.4 trillion in investments to cover their infrastructure needs by 2040. Global Infrastructure Hub (GIH) reported on July 3 ), a G20 initiative in two studies involving the Compact with Africa countries; a plan launched by Germany to attract private investment in Africa. These countries are: Morocco, Tunisia, Egypt, Ethiopia, Senegal, Guinea, Ivory Coast, Ghana, Benin, Rwanda. The first “Global Infrastructure Outlook: Infrastructure Investment Need in the Compact with Africa Countries” report revealed a need for infrastructure investments of $ 2.4 trillion in 10 countries by 2040, if they want to keep pace with economic growth and fill infrastructure gaps.

It is expected that only US $ 1.4 trillion will be delivered based on current spending levels. This represents an investment gap of 42%, one of the largest regional differences in the world.

A gap of 1000 billion dollars of investments to be filled

Moreover, on the investment deficit of $ 1000 billion, $ 415 billion will be needed by 2030 if these countries want to achieve the United Nations Sustainable Development Goals (SDGs) for universal access to water drinking water, sanitation and electricity. The second “Outlook” report provides – for the first time – the magnitude of infrastructure investment needs, current investment trends and corresponding investment spreads in 10 Pact countries with Africa at the global level. countries and sectors. He noted, however, that emerging markets remain attractive for investors.

Take advantage of the attractiveness of emerging markets

According to the 2017 Annual Global Infrastructure Investor Survey of the Global Infrastructure Hub and the EDHEC Infrastructure Institute-Singapore, 37% of infrastructure investors are investing in emerging markets, up from 20% in 2016. Among those already investing in emerging markets 82% want to increase their investment in the 10 program countries.

“These numbers clearly demonstrate investors’ desire to spend more on emerging markets. However, attracting private sector investment to African countries remains a major challenge, “said Chris Heathcote, CEO of Global Infrastructure Hub.

“The key to solving this problem is to create the right environment to encourage investors to turn their interest into action,” he added.

La Tribune Afrique

Leave a Reply