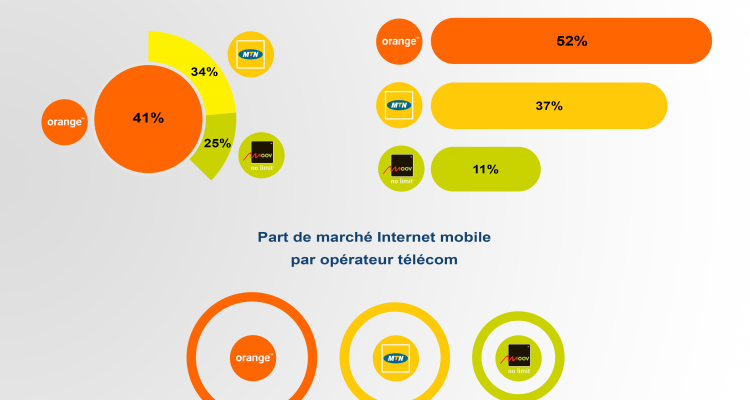

Market share of different operators on Mobile Money

On the digital market in Côte d’Ivoire, we have 33,345,000 mobile phone subscribers, representing a penetration rate of 131.60%, 12,530,000 subscribers have a mobile money account, which represents more 30% of subscribers. Daily financial transactions via mobile money represent a volume of 17 billion FCFA, or 25.9 million euros. If mobile money was initially used for money transfers, its use has evolved and is also used for paying bills (water, electricity, etc.), registration fees in schools and administrative competitions , for the payment of services provided by e-commerce, etc.

This new payment system puts non-bank money transfer financial institutions (Western Union, MoneyGram), banks and mobile phone operators in opposition. Some banks such as those shown in Table 1 have aligned themselves in the provision of mobile money services. In 2015, the financial institution Western Union partnered with MTN to set up a service allowing customers to receive funds transferred from one of the agencies of the American group directly into their mobile wallet.

Western Union and MoneyGram dominated the money transfer market before the arrival of Mobile Money.

Banking services

Faced with the increasing growth rate of mobile banking, banking institutions are aligning themselves with the paradigm shift so as not to be overwhelmed by telecommunications operators, who are masters of money transfer and electronic payment. Despite the fact that the Ivorian banking sector is the leader within the UEMOA zone, digital is still in its infancy. Hence the inclusive deployment of online banking services, with an emphasis on innovation and creativity. Banking services available from an application (account opening, bank transfers, etc.), remote account opening via data transfers by email, etc. Several services using digital are becoming available. However, the population remains reluctant and the rate of banking remains low, around 20%.

Start-ups

Some SMEs are currently launching into electronic money, but are still in the embryonic stage.

Read also: https://www.afrikatech.com/e-education/launch-code213-first-algerian-school-devoted-web-professions/

Other: https://en.unesco.org/creativity/policy-monitoring-platform/la-cote-divoire-mise-sur

Leave a Reply